CTC Structuring

CTC structuring that empowers more creative compensation planning and tactical choices.

Our HRMS simplifies CTC structuring, ensuring accurate payroll and improved compliance.

HR365 simplifies CTC structuring with advanced payroll software.designed for growing businesses, our platform provides quick and easy breakdowns of every compensation component, ensuring transparency and compliance at every step.

With HR365, HR and finance teams can easily design fair, legally compliant compensation packages, from basic salary components to comprehensive benefits. Our solution provides fast processing, cloud-based access, and strong data security, equipping you with the tools to streamline payroll and CTC management efficiently.

Our key features

HR365 is a flexible, customizable software designed to meet the specific needs of your business and employees.

Fast implementation

Swift processing

Data security

Cloud First

Transparency

People Focused

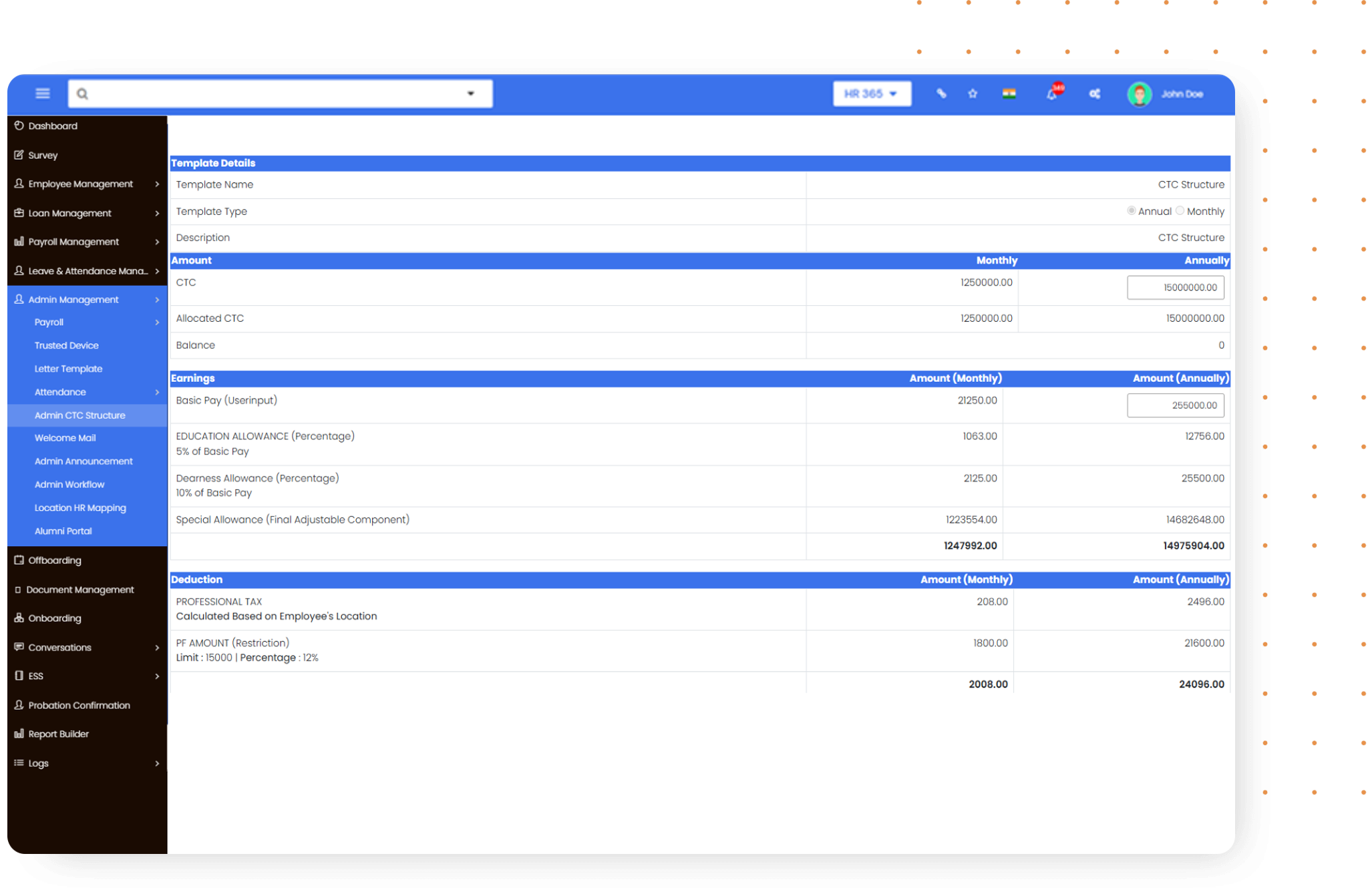

Optimize CTC calculations for seamless Pay Structure Templates

-

Pay Structure Templates

Pay Structure TemplatesCreate and assign predefined salary templates to different employee groups and designations.

-

Automated CTC Calculations

Automated CTC CalculationsCalculate the total cost to a company automatically based on defined structures.

-

Flexible Component Configuration

Flexible Component ConfigurationEasily define fixed and variable components.

Components of CTC

Benefits

An employee’s salary structure is built around fixed pay. This usually consists of elements like the basic wage, the House Rent Allowance (HRA), and regular benefits like dearness or travel allowances in India. Income tax regulations apply to these elements, which make up the majority of an employee’s monthly compensation.

Variable Pay

The performance-based elements of the CTC, including bonuses, sales incentives, or project-based rewards, are referred to as variable pay. It gives companies flexibility and aims to match worker performance with company objectives. In India, these payments might be correlated with certain KPIs or yearly evaluations.

Perks and Benefits

Among the many other perks are medical insurance, food vouchers, leave travel allowance (LTA), employee state insurance (ESI), and employee provident fund (EPF). These are crucial for retaining and satisfying employees, and they frequently have tax benefits. Employers are permitted to offer a number of perks under Indian tax regulations that are free from income tax.

Statutory Deductions

Tax Deducted at Source (TDS), Professional Tax, EPF, and ESI are examples of statutory deductions that are required by Indian law. Legally, these deductions from employees’ salaries must be made. The right percentage is applied based on geography and income thanks to HR365’s automation of these deductions.

Our other solutions

Our HR & payroll software is highly customizable to meet the unique needs of your business. Whether you have a small or large team, our software can scale to accommodate your business as it grows.

Say goodbye to tedious manual calculations and paperwork and hello to increased efficiency and accuracy in your HR & payroll process.

Our other solutions

Our HR & payroll software is highly customizable to meet the unique needs of your business. Whether you have a small or large team, our software can scale to accommodate your business as it grows.

Our other solutions

Our HR & payroll software is highly customizable to meet the unique needs of your business. Whether you have a small or large team, our software can scale to accommodate your business as it grows.

Say goodbye to tedious manual calculations and paperwork and hello to increased efficiency and accuracy in your HR & payroll process.

Say goodbye to tedious manual calculations and paperwork and hello to increased efficiency and accuracy in your HR & payroll process.

Book a demo

HR365 is the market-leading HR & Payroll software.

Find out how we can help transform your business today.